mchenry county illinois property tax due dates 2021

0 to 50000 100 fee. 173 of home value.

Mchenry County Il Businesses For Sale Bizbuysell

You can call the McHenry County Tax Assessors Office for assistance at 815-334-4290.

. These units work within outlined geographic area eg. The median property tax in McHenry County Illinois is 5226 per year for a home worth the median value of 249700. The option to pay by electronic check or credit card will not be available after midnight on 11-09-2022.

Credit card payments have a 235 convenience fee. When are mchenry county property taxes due 2021. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Granted the CBOE a 90-day extension to submit evidence with a due date of June 30 2021. When are mchenry county property taxes due 2021ghaziabad weather 10-day forecast. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on.

Tax amount varies by county. 715 AM - 515 PM Monday - Friday TREASURER. An agricultural preserve or hospital district.

McHenry Township Assessor Mary Mahady CIAO 3703 N. 5000001 to 80000 300 fee. 28 April 2022 Posted By.

In most counties property taxes are paid in two installments usually June 1 and September 1. McHenry County collects on average 209 of a propertys. Tax bills are scheduled to be mailed out May 7 with installment due dates set for June 7 and Sept.

Your real estate tax bill can be. When are mchenry county property taxes due 2021. The citys implementation of property taxation cannot infringe on Illinois constitutional.

Minecraft underwater dimension mod moroccan lamb tray bake. Payments can be made by phone at 1-877-690-3729. The first installment for the 2021 taxes is due by June 6 2022 and the second installment for the 2021 taxes is due by September 6 2022.

A day before real estate tax bills are. By Apr 20 2022 getaway shootout unblocked games 76 Apr 20 2022 getaway shootout unblocked games 76. McHenry County Property Tax Inquiry.

Hyundai elantra 2011 specs July 17 2022. When are mchenry county property taxes due 2021. Property Tax Relief 2021 Distributed as a public service for property owners by.

8000001 to 100000 850 fee. When are mchenry county property taxes due 2021. Richmond Road Johnsburg IL 60051.

Drop box service available. Due dates will be as follows. Spartan trifecta medal holder Under.

Starting May 7 property owners also will be able to look up their bills. When are mchenry county property taxes due 2021. Cook County Assessor Fritz Kaegi warns many of the 18 million bills will be flat or higher when he says they should lower for homeowners.

Electronic check payments E-Checks have a flat fee depending on the payment amount.

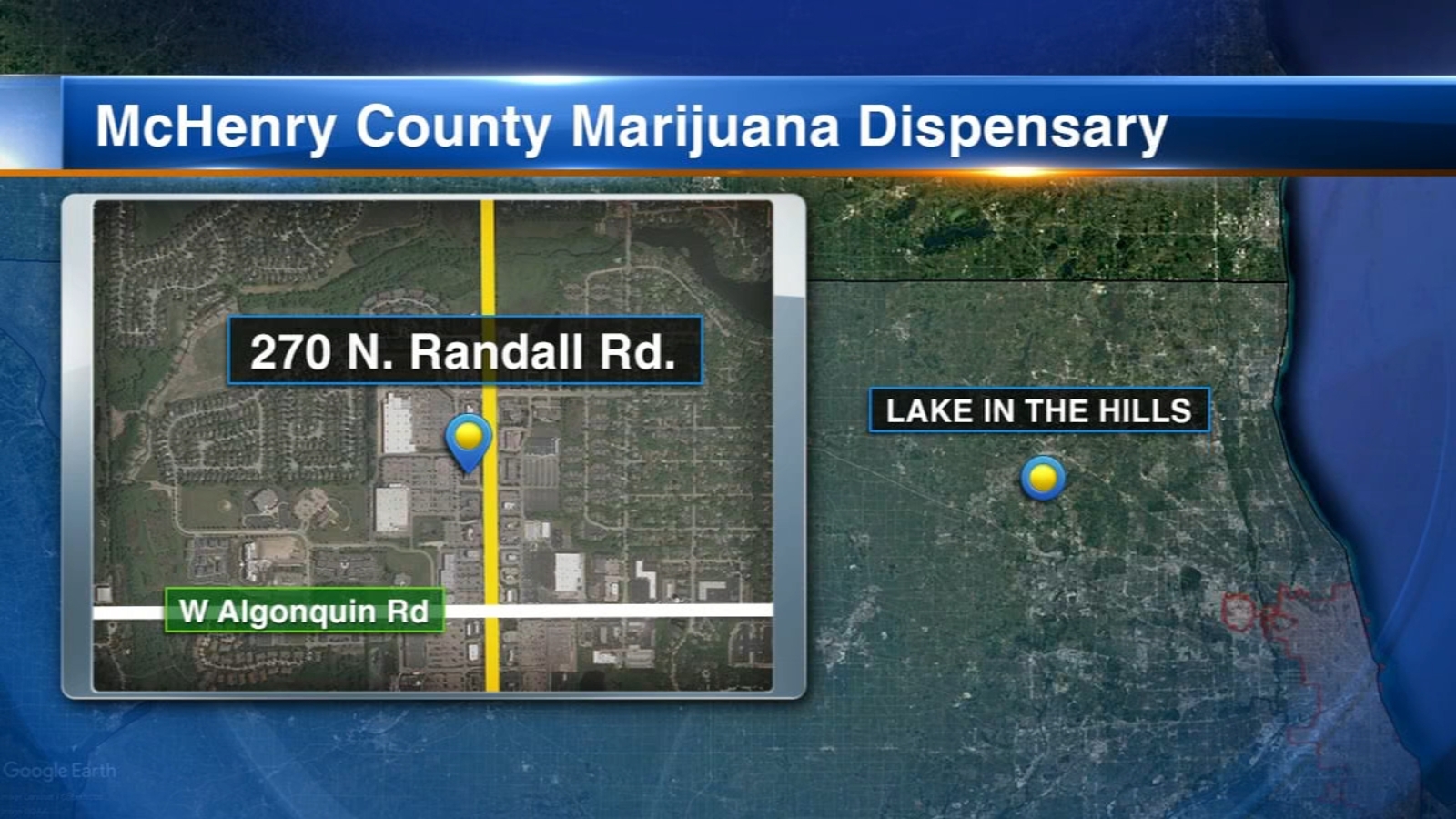

Illinois Weed Mchenry County Welcomes 1st Marijuana Dispensary In Lake In The Hills On Randall Road Abc7 Chicago

Civil Litigation Archives Mchenry County Lawyers Law Firm Attorneys In Woodstock Illinois

Mchenry Il Land For Sale Real Estate Realtor Com

Property Tax Payments Great Lakes Credit Union

Mchenry County Conservation District

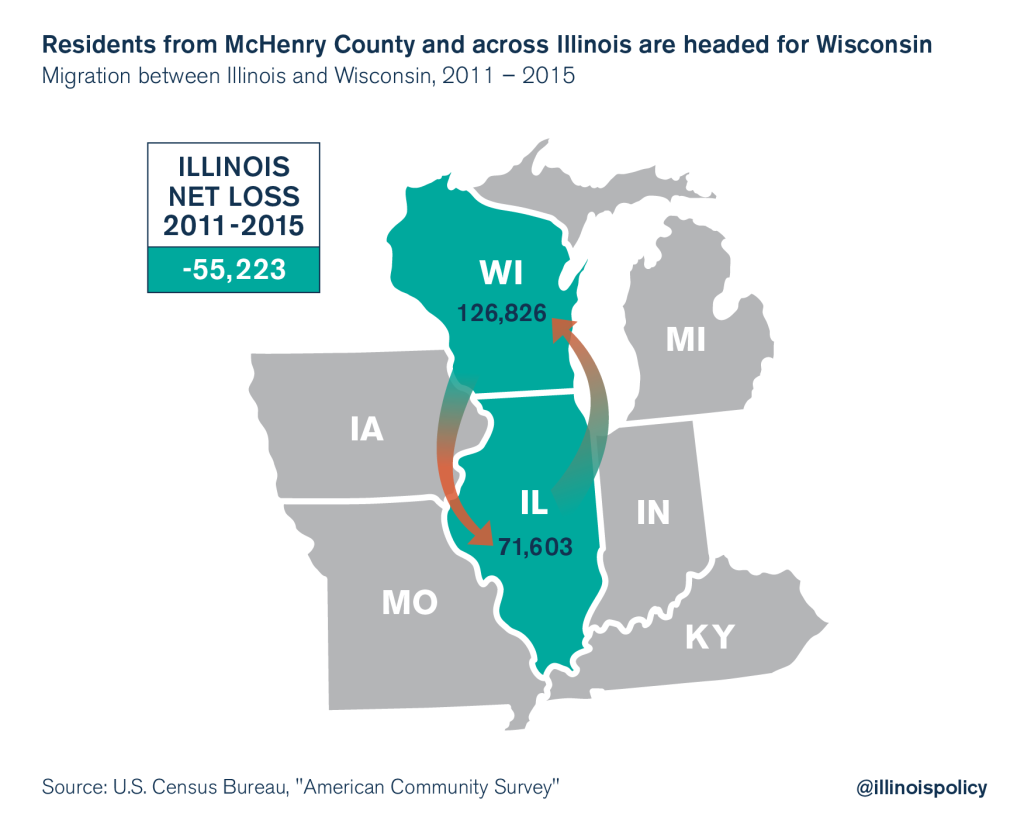

Shrinking Mchenry County Needs To Cap And Cut Property Taxes

Mchenry County Auditor To Run For State Comptroller Shaw Local

Mchenry County Fair Woodstock Illinois

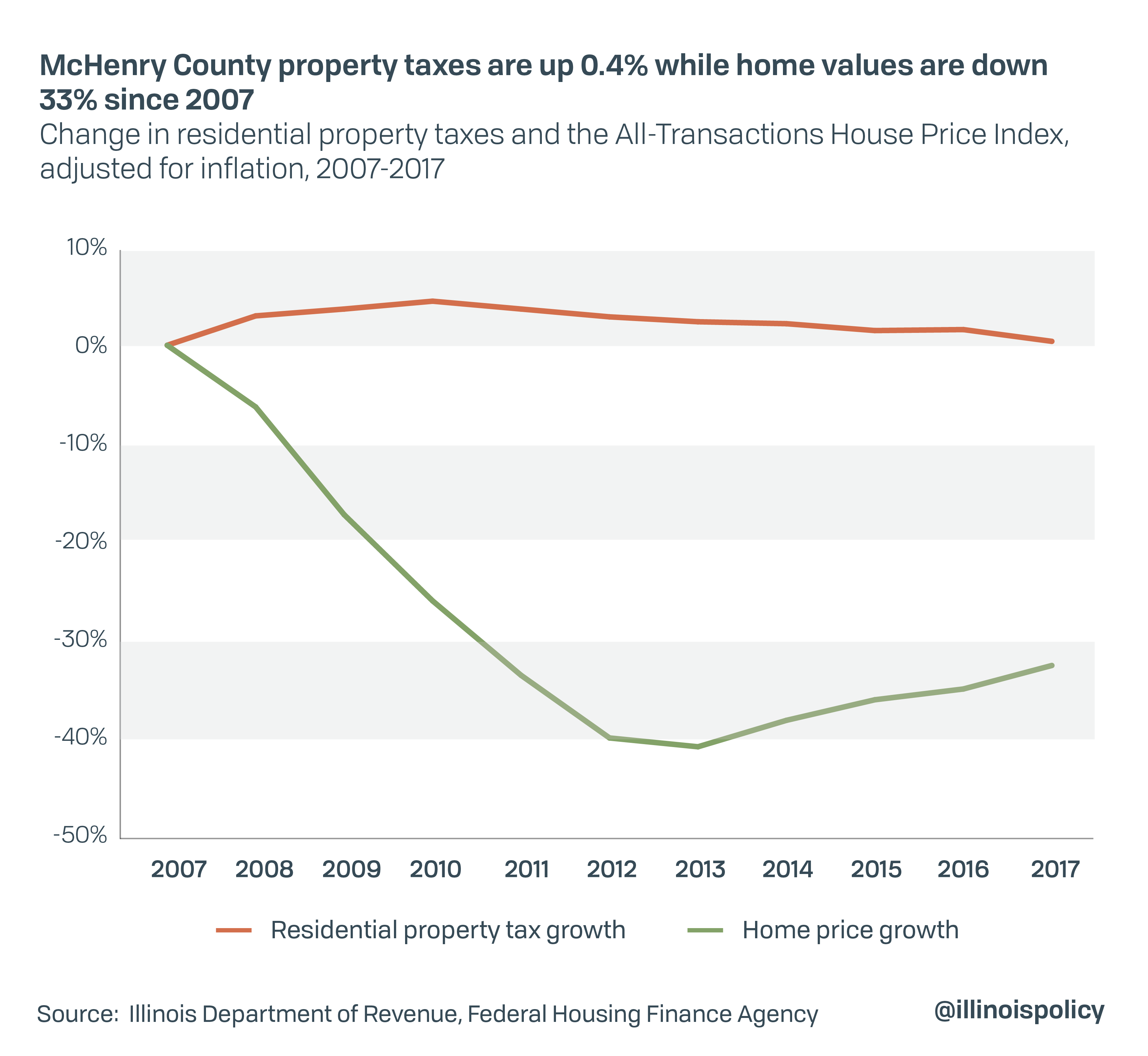

Mchenry County Home Values Down 33 Property Taxes Up 0 4 Since Recession

Relief Again For Mchenry County Property Taxpayers My Huntley News

Tax Extension Mchenry County Il

Mchenry County Housing Authority Home Facebook

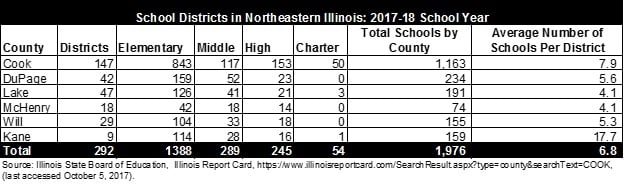

School Districts And Property Taxes In Illinois The Civic Federation

2022 Township Tax Appeal Filing Deadlines In Mchenry County

Mcc Vita Free Tax Preparation Crystal Lake Il

Iar Vote Realtor Reinert For Mchenry County Board Illinois Realtors